XRP Price Prediction: Will XRP Hit $3 Amid Current Market Conditions?

#XRP

- XRP is trading below key moving averages but shows building momentum in MACD indicators

- Ripple's strategic acquisitions and treasury initiatives create fundamental bullish pressure

- The $3 target requires breaking through multiple resistance levels but remains achievable

XRP Price Prediction

XRP Technical Analysis: Testing Critical Support Levels

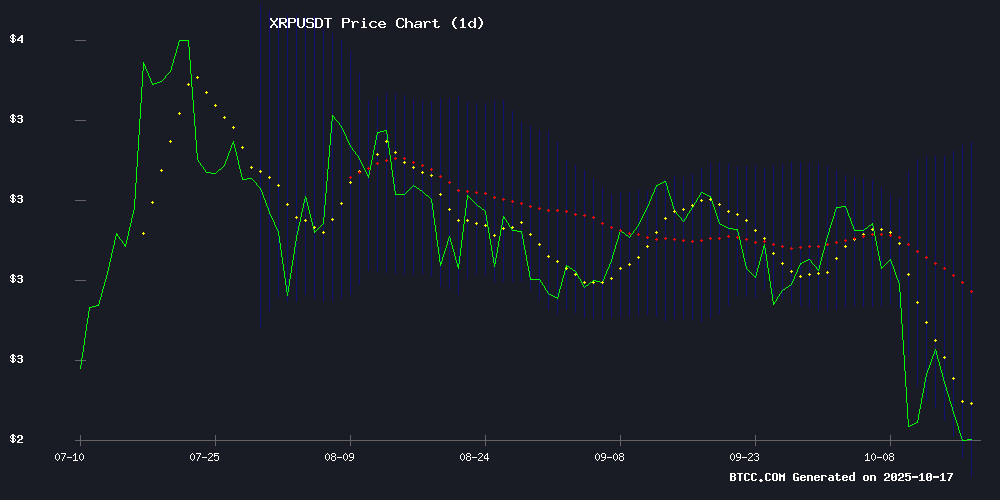

According to BTCC financial analyst Sophia, XRP is currently trading at $2.307, below its 20-day moving average of $2.7259, indicating short-term bearish pressure. The MACD reading of 0.2384 above the signal line of 0.1231 suggests potential momentum building. However, price action NEAR the lower Bollinger Band at $2.2124 shows XRP is testing crucial support levels that could determine the next major move.

Mixed Market Sentiment Amid Strategic Developments

Sophia from BTCC notes that while technical indicators show short-term pressure, fundamental developments remain strongly positive. Ripple's strategic acquisition of GTreasury and their $1 billion treasury market initiative could create significant buying pressure for XRP. The potential supply squeeze from DeFi adoption and regulatory advocacy by Ripple's CEO provides strong long-term bullish catalysts, though current market sentiment reflects the technical resistance levels.

Factors Influencing XRP's Price

XRP's Technical Setup Hints at Potential Explosive Breakout, Analyst Suggests

XRP appears poised for a significant price movement as technical analysis reveals a tightening bullish structure. Market analyst Mikybull identifies an ABC correction pattern nearing completion, with the cryptocurrency currently hovering around $2.50—a level historically acting as strong support.

The Fibonacci extension levels paint an ambitious roadmap: $1.94 (1.00), $3.25 (1.272), and $6.28 (1.618). A decisive break above the $3.25 resistance could trigger momentum trading toward the $6.28 target. "This setup is going to be explosive during breakout," Mikybull noted, referencing XRP's compressed trading range that historically precedes volatile price expansions.

Traders are monitoring the 1.272 Fibonacci level as the critical threshold. The technical pattern suggests the corrective phase may be concluding, potentially setting the stage for a rapid upward trajectory if key resistance levels are breached.

Ripple's Strategic Acquisition of GTreasury Paves Way for XRP in Corporate Finance

Ripple's move to acquire GTreasury marks a pivotal moment for XRP's integration into global treasury systems. The deal positions Ripple to embed its digital assets—XRP and the upcoming RLUSD stablecoin—into the $100 trillion treasury market without disrupting existing corporate workflows. GTreasury's established software, which connects multinational corporations to banking and payment systems like SWIFT, serves as a ready-made conduit for blockchain-based settlement.

Market observers highlight the acquisition's technical significance rather than speculative hype. By leveraging GTreasury's ISO20022-compliant infrastructure, Ripple bypasses the need for direct enterprise sales. The orchestration LAYER already standardizes cash flows between ERPs, bank portals, and payment networks—creating a frictionless path for digital asset adoption. This follows Ripple's recent acquisitions of Hidden Roads and Standard Custody, forming a trifecta of institutional-grade infrastructure.

XRP Supply Squeeze Looms as DeFi Adoption Tightens Circulating Supply

Crypto analyst Zach Rector warns that XRP's long-debated supply shock narrative is transitioning from meme to market reality. The altcoin's growing integration with Flare Network's DeFi ecosystem is visibly reducing liquid supply through escrow locks and tokenization.

Recent on-chain activity shows 4 million XRP ($11.2M) moved to Flare Core vaults, following Rector's own experiments minting 190 FXRP for yield generation. This institutional-grade demand could create measurable supply pressure absent in previous market cycles.

Unlike speculative chatter in 2017-2018, the current supply constraints stem from verifiable blockchain mechanics. As more XRP gets deployed in DeFi protocols without leaving the XRP Ledger, exchange inventories may face unexpected shortages during demand spikes.

Ripple CEO Calls for Regulatory Parity Between Crypto and Traditional Finance

Ripple CEO Brad Garlinghouse has highlighted the regulatory disparity between cryptocurrency firms and traditional banks, arguing that crypto companies face stricter scrutiny despite adhering to the same compliance standards. Speaking at DC Fintech Week, Garlinghouse emphasized that Anti-Money Laundering (AML), Know Your Customer (KYC), and Office of Foreign Assets Control (OFAC) regulations apply equally to both sectors, yet crypto firms encounter additional hurdles.

Garlinghouse urged regulators to establish a level playing field, noting that leadership changes at agencies like the SEC or WHITE House won't resolve the issue without a clear framework for equitable treatment. "The problem isn't about who's in charge," he said. "It's about having one set of fair rules for everyone." The remarks come as Ripple awaits a decision on its national charter.

$1 Billion XRP Buying Pressure Ahead? Ripple Labs Plans New DAT Initiative

Ripple Labs is spearheading a bold move to raise at least $1 billion for XRP accumulation through a newly proposed digital-asset treasury (DAT). According to Bloomberg, this initiative signals unwavering institutional confidence despite recent market turbulence. The capital WOULD be raised via a special purpose acquisition company (SPAC), with Ripple contributing part of its own XRP holdings.

The scale of the proposed fund positions it as potentially the largest XRP-focused accumulation vehicle to date. Its SPAC-based structure mirrors the 2025 trend of publicly listed token investment vehicles gaining traction through reverse mergers. Market observers note the timing is particularly striking—launching against a backdrop of fragile sentiment following last week's historic liquidations.

While terms remain fluid and Ripple declined official comment, the mere contemplation of such a substantial position build suggests institutional players see current levels as an accumulation zone. The DAT model itself represents an evolution in crypto balance sheet strategies, blending traditional corporate finance mechanisms with digital asset treasury management.

Ripple's $1B Strategic Move Targets $120T Treasury Market Through XRP Integration

Ripple Labs Inc. is making a bold play for institutional adoption with a $1 billion Special Purpose Acquisition Company (SPAC) deal aimed at accumulating XRP for Digital Asset Treasury (DAT) applications. The acquisition of GTreasury—a SaaS platform serving corporate treasuries—positions XRP as a real-time liquidity engine for legacy financial systems.

While competitors like MicroStrategy face market headwinds, Ripple's aggressive expansion into the $120 trillion corporate treasury market demonstrates conviction. The GTreasury integration provides tangible utility beyond speculative trading, offering corporations blockchain-native cash management solutions.

This strategic pivot comes as DATs face scrutiny during market turbulence. Ripple's focus on enterprise-grade infrastructure rather than retail speculation could redefine XRP's role in institutional finance.

Ripple Expands Corporate Treasury Reach With $1 Billion Acquisition Of GTreasury

Ripple, the company behind the XRP cryptocurrency, has taken a significant step in its growth strategy by acquiring GTreasury for $1 billion. This MOVE grants Ripple immediate access to the multi-trillion dollar corporate treasury market and a portfolio of high-profile clients, including Accenture, Cognizant, and Bank Australia.

Brad Garlinghouse, Ripple's CEO, highlighted the inefficiencies of traditional payment systems, noting that blockchain technology is uniquely positioned to solve these challenges. The merger aims to unlock trapped capital, enable instant payments, and create new growth opportunities for treasury and finance teams.

This acquisition marks Ripple's third major deal in 2025, signaling its aggressive push into the digital asset space as the financial landscape continues to evolve.

Ripple Price Analysis: XRP Tests Critical Support After 22% Weekly Decline

Ripple's XRP faces a pivotal moment as its price hovers NEAR $2.30, a confluence zone where the 200-day moving average intersects with a wedge pattern's lower boundary. The token has shed 22% of its value since last week's market-wide liquidation event, breaking below both the 100-day and 200-day moving averages.

Technical indicators suggest the $2.30 level represents the last defense before a potential drop to the institutional demand zone between $2.00 and $1.30. Market structure remains fragile, with bulls needing to reclaim $2.60-$2.70 to invalidate the bearish breakdown. The asset's failure to hold this level could trigger a deeper correction toward long-term accumulation zones.

On shorter timeframes, the 4-hour chart confirms the breakdown of key trendlines and support levels. Traders await either a decisive bounce from current levels or confirmation of continued downside momentum.

XRP Price Prediction and the Rise of Remittix as a Hedge Option

XRP's price action remains a focal point for traders, with current levels hovering around $2.34. Analysts suggest a breakout above $3.10 could propel the token toward $3.30, while a drop below $2.85 may see it retreat to $2.70. Long-term projections place XRP between $3.03 and $4.84 by 2026.

Amidst this volatility, XRP holders are diversifying into Remittix, a payments-focused altcoin offering built-in utility and rewards. Unlike XRP's reliance on regulatory developments, Remittix emphasizes a crypto-to-fiat transfer network, positioning itself as a growth play. The project's beta wallet is live, complemented by a 15% USDT referral program and a $250,000 giveaway. Listings on BitMart and LBank underscore its momentum, with another exchange listing imminent.

Ripple Labs Leads $1B Fundraise for XRP Treasury Amid Market Volatility

Ripple Labs is spearheading a $1 billion fundraising initiative through a special purpose acquisition company (SPAC) to establish a digital asset treasury (DAT) focused on accumulating XRP tokens. Despite recent market turbulence, the move underscores Ripple's commitment to advancing its strategic objectives.

The fintech giant will contribute a portion of its substantial XRP holdings to the new DAT. With 4.74 billion XRP ($11 billion) in direct custody and nearly 36 billion in escrow, Ripple controls over 40% of the token's total supply. This positions the company as a dominant force in the XRP ecosystem.

Separately, Ripple announced a $1 billion acquisition of treasury software provider GTreasury, signaling its ambition to disrupt the $120 trillion corporate treasury payments market. "Astounding amounts of cash remain trapped in outdated payment systems," said CEO Brad Garlinghouse, highlighting the opportunity for blockchain-based solutions.

XRP Faces Downside Risk as Bulls Struggle to Break Key Resistance

XRP remains under selling pressure, with its price trapped below critical resistance levels. The token currently trades at $2.27, reflecting a 6% daily decline and a 19% weekly drop. Market participants are closely monitoring two technical barriers: the $2.4 level (a former support turned resistance) and the $2.8 Fibonacci retracement zone.

Analyst Lark Davis highlights the significance of a weekly close above $2.8 to avert further downside. The daily chart shows concerning signals, with the 50-day moving average crossing below the 100-day MA—a pattern that preceded three sharp declines earlier this year, including one 46% plunge.

Momentum indicators continue to weaken, suggesting bears may maintain control unless buyers can force a decisive breakout. The market appears to be at an inflection point, where failure to reclaim higher levels could trigger another leg down in XRP's valuation.

Will XRP Price Hit 3?

Based on current technical and fundamental analysis, Sophia from BTCC believes XRP reaching $3 is achievable in the medium term, though immediate resistance presents challenges. The current price of $2.307 requires approximately 30% upside to reach the $3 target.

| Key Levels | Price | Significance |

|---|---|---|

| Current Price | $2.307 | Testing support |

| 20-day MA | $2.726 | Immediate resistance |

| Upper Bollinger | $3.239 | Next major target |

| Target Price | $3.000 | 30% upside required |

The combination of strong fundamental developments including Ripple's treasury market expansion and potential supply constraints, coupled with building technical momentum, suggests XRP could reach $3 once it clears the $2.726 resistance level. However, traders should monitor the $2.212 support closely as a break below could delay this target.